Is BlackRock Holding More BTC Than copyright?

When we talk about Bitcoin giants, BlackRock and copyright come up frequently.

Let's dive into the truth behind the Bitcoin ownership battle.

Why BlackRock’s Bitcoin Moves Matter

BlackRock manages traditional investments like stocks and bonds—and now copyright too.

{Their entry into Bitcoin shows institutional acceptance|They invest using ETFs, not always direct purchases|This means they impact the market without storing BTC.

copyright and Its Bitcoin Holdings

copyright is copyright-native—it lives and breathes digital assets.

copyright holds BTC to enable transactions, not to invest like BlackRock.

How Does Each Handle Bitcoin?

BlackRock

Doesn’t always buy BTC directly

May control billions in assets linked to Bitcoin

copyright

Hosts the Bitcoin of millions of users

May not “own” BTC, but controls a lot

BlackRock vs. copyright by the Numbers

copyright: Holds over 600,000 BTC publicly

BlackRock: Has growing BTC exposure via ETFs

Right now, copyright clearly holds more BTC.

Why the BTC Battle Is Important

Bitcoin is about influence and power.

BlackRock’s growing BTC presence shows mainstream adoption

copyright’s massive holdings show how big copyright-native companies have become

Future Trends That Could Flip the Numbers

BlackRock’s ETF Approval: Could open the door to billions in BTC exposure

copyright Expansion: Continues adding users and services globally

Market Volatility: Rapid market moves might change holdings overnight

Beyond BlackRock and copyright

MicroStrategy: Over 150,000 BTC

Grayscale: Institutional holdings via GBTC

Tesla: click here Famous corporate holder of Bitcoin

BlackRock leads the institutional front

Why Should You Care?

copyright dominance = stronger copyright-native economy

Exchange power keeps BTC decentralized

Watch these giants—they shape Bitcoin’s future

Who’s Winning the Bitcoin Battle?

BlackRock isn’t there yet—but it’s close behind.

Stay alert—this race isn’t over.

copyright power isn’t just about price—it’s about who holds the keys.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Romeo Miller Then & Now!

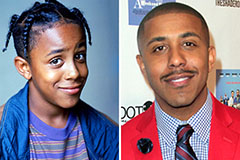

Romeo Miller Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!